If you're getting ready to purchase a new home, it's important to plan your mortgage payments. One of the most common things people worry about when planning their mortgage payments is how they will keep track of them. A lot of what makes this task difficult is that mortgage payment can be split into interests and categories, such as fixed-rate payments or interest-only payments for each category. But many people don't know how to do so correctly, which can lead them to pay too much or not enough (or worse yet, overpay).

Luckily there are some great websites and calculators out there that help you plan out your mortgage payments so you can avoid any potential problems. For example, if you plan on getting a mortgage through the government, which is guaranteed by the US Department of Treasury (not guaranteeing most mortgages), you can use the calculator provided at www.usdcfinancial.com to help you plan out your options. If you are planning on getting a mortgage from a private bank (which is not guaranteed by the government) then you can use this site to help you figure out your payment options during your early years of homeownership.

All in all, it's important to do some research into making sure that you're getting a good deal when purchasing a home and properly budgeting your payments will go a long way towards making this step easier. And if you get stuck, then don't be afraid to ask for help. Just do your research first so you can be sure that you aren't going to overpay or underpay!

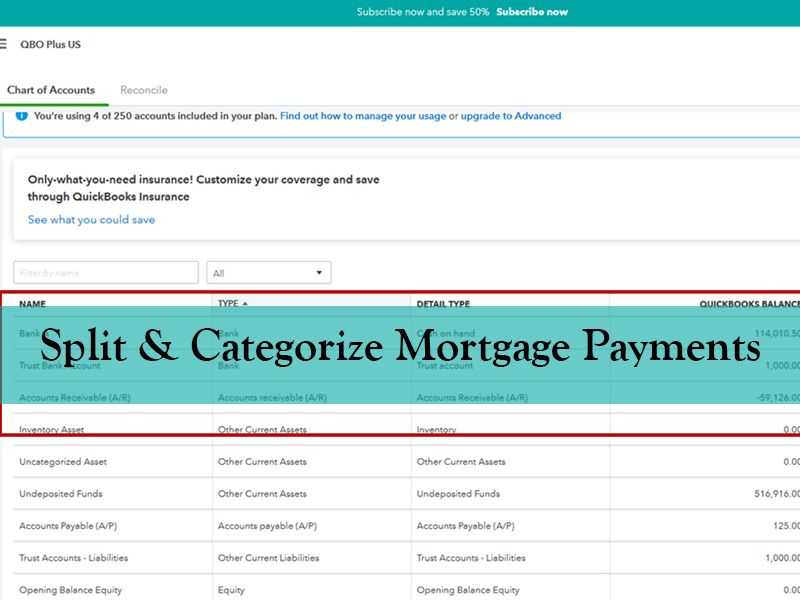

Split & Categorize Mortgage Payments

Before making any decisions about buying a home, it's important to make sure that you fully understand the process of getting a mortgage. The biggest question people have about mortgages is how to split the payments up into interest and principal payments so that they can keep track of them correctly.

Split & Categorize Mortgage Payments

If you're getting ready to purchase a new home, it's important to plan your mortgage payments. One of the most common things people worry about when planning their mortgage payments is how they will keep track of them. A lot of what makes this task difficult is that mortgage payment can be split into interests and categories, such as fixed-rate payments or interest-only payments for each category. But many people don't know how to do so correctly, which can lead them to pay too much or not enough (or worse yet, overpay).

Luckily there are some great websites and calculators out there that help you plan out your mortgage payments so you can avoid any potential problems. For example, if you plan on getting a mortgage through the government, which is guaranteed by the US Department of Treasury (not guaranteeing most mortgages), you can use the calculator provided at www.usdcfinancial.com to help you plan out your options. If you are planning on getting a mortgage from a private bank (which is not guaranteed by the government) then you can use this site to help you figure out your payment options during your early years of homeownership.

All in all, it's important to do some research into making sure that you're getting a good deal when purchasing a home and properly budgeting your payments will go a long way towards making this step easier. And if you get stuck, then don't be afraid to ask for help. Just do your research first so you can be sure that you aren't going to overpay or underpay!

Before making any decisions about buying a home, it's important to make sure that you fully understand the process of getting a mortgage. The biggest question people have about mortgages is how to split the payments up into interest and principal payments so that they can keep track of them correctly.

Now let us analyse and differentiate between escrow vs principal payments.

A difference between escrow and principal payments.

One of the big differences between escrow accounts and classic investment or principal payments is how much money you will actually end up with at the end of your investment. If you plan on purchasing a product or service online, using an escrow account can protect you from fraud disputes, payment disputes, fraud charges for products not received, etc. Escrow ensures that funds are released only after all terms are met by the purchaseee. When using an escrow account, funds can be transferred to a third party in case of dispute while still remaining in your possession until you're satisfied with their performance. A difference is easy to see when looking more closely at payment and transaction stages.

If you invest with a classic investment or principal payments account, there are just two stages: deposit and withdrawal. The investment is open-ended, and you can continue to deposit money into your account as long as you like. The advantage of this system is that investing continues over time, while the disadvantage is that there's no way to get your money back until the contract expires or until you negotiate a new one with the company.

If you make an escrow deposit, then there are three stages: opening, fund storage, and closing. The opening stage is when you give the escrow agent access to the money you wish to deposit in the escrow account. The fund storage stage is when you have your money longer than five business days, and it's important because not only do you receive notification that your funds are being held, but you also receive a refund of any fees charged for your transaction. The closing stage is when the escrow agent releases the funds to their rightful owner - in this case, your investment account. At this point, you've either received all or part of your investment back or will have a final opportunity to get more of it - if there are any remaining funds that weren't deposited with Escrow Services Transfers.

In most cases, it's impossible for the escrow agent to actually release funds to you until all conditions of the contract are met. However, with Escrow Services Transfers, you're allowed to get all or part of your investment back if you request a release - even before the five-day holding period is up.

This is all that you need to know about escrow vs principle.

For more information, you can visit Real Estate Calculators.